The Valley Chronicle - Borrowing to fund pensions could make Californi

Borrowing to fund pensions could make California the next Puerto Rico

Marc Joffe is the director of Policy Research at the California Policy Center. In 2011, Joffe founded Public Sector Credit Solutions to educate policymakers, investors and citizens about government credit risk. His research has been published by the California State Treasurer’s Office, the Mercatus Center at George Mason University, the Reason Foundation, the Haas Institute for a Fair and Inclusive Society at UC Berkeley and the Macdonald-Laurier Institute among others. He is also a regular contributor to The Fiscal Times. Prior to starting PSCS, Marc was a Senior Director at Moody’s Analytics. He has an MBA from New York University and an MPA from San Francisco State University.

Soboba Band of Luiseño Indians

staffLeprechauns bring lots of green to Soboba Tribal Preschool

English, Valley Chronicle: Thu, Feb 25, 2021

English, Valley Chronicle: Thu, Feb 25, 2021

Koi Nation of Northern California and California State Parks

staffKoi Nation of Northern California, USA

English, Valley Chronicle: Thu, Dec 8, 2022

24 Kids Shop with a Cop in Hemet

staff24 Kids Shop with a Cop in Hemet

English, Valley Chronicle: Thu, Dec 8, 2022

English, Valley Chronicle: Thu, Dec 8, 2022

MSJC Hosts Temecula Valley Campus Dedication Ceremony

staffMSJC Hosts Temecula Valley Campus Dedication Ceremony

English, Valley Chronicle: Thu, Dec 8, 2022

NFPA urges added caution this holiday season, as Christ

staffNFPA urges added caution this holiday season, as Christmas Day and Christmas Eve are among the leading days of the year for U.S. home fires

English, Valley Chronicle: Thu, Dec 8, 2022

Stick to a “Go Safely” Game Plan: Celebrate the Holiday

staffStick to a “Go Safely” Game Plan: Celebrate the Holiday Season Responsibly National “Drive Sober or Get Pulled Over” Enforcement Campaign Begins Dec. 14

English, Valley Chronicle: Thu, Oct 27, 2022

Padilla Hosts Virtual Federal Student Debt Relief Brief

staffPadilla Hosts Virtual Federal Student Debt Relief Briefing to Encourage Californians to Apply

English, Valley Chronicle: Thu, Jun 9, 2022

English, Valley Chronicle: Thu, Jun 9, 2022

Police Seek Help Locating Hit-and-Run Vehicle

staffPolice Seek Help Locating Hit-and-Run Vehicle

English, Valley Chronicle: Thu, Jun 9, 2022

English, Valley Chronicle: Thu, Jun 9, 2022

Four CSUSB alumni win top award for radio show

staffFour CSUSB alumni win top award for radio show

English, Valley Chronicle: Thu, Jun 9, 2022

Follow-up: Plane Crashes Near Residential Homes in Heme

staffFollow-up: Plane Crashes Near Residential Homes in Hemet

English, Valley Chronicle: Thu, Jun 9, 2022

CSUSB Nursing Street Medicine Program partners with new

staffCSUSB Nursing Street Medicine Program partners with new mobile medical clinic

English, Valley Chronicle: Thu, Jun 9, 2022

Padilla Joins Farm Workers for a Workday as Part of the

staffPadilla Joins Farm Workers for a Workday as Part of the ‘Take Our Jobs’ Campaign

English, Valley Chronicle: Thu, Mar 24, 2022

CHP plans DUI checkpoint in Hemet Valley

staffCHP plans DUI checkpoint in Hemet Valley

English, Valley Chronicle: Thu, Mar 24, 2022

Don't undermine scientific discovery -- ever, but espec

staffDon't undermine scientific discovery -- ever, but especially now

English, Valley Chronicle: Thu, Mar 24, 2022

C.W. Driver companies breaks ground on new three-story

staffC.W. Driver companies breaks ground on new three-story stem education building

English, Valley Chronicle: Thu, Mar 24, 2022

English, Valley Chronicle: Thu, Mar 24, 2022

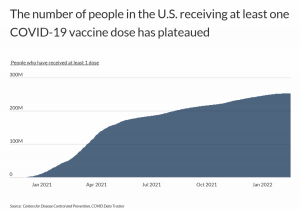

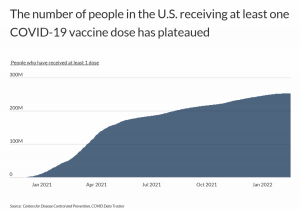

35.3% Of Unvaccinated California Residents Cite Governm

staff35.3% Of Unvaccinated California Residents Cite Government Distrust

English, Valley Chronicle: Thu, Mar 24, 2022

ICYMI: Padilla Highlights From Judge Jackson’s Supreme

staffICYMI: Padilla Highlights From Judge Jackson’s Supreme Court Confirmation Hearing

English, Valley Chronicle: Thu, Mar 24, 2022

MSJC Celebrates Groundbreaking of New STEM Building and

staffMSJC Celebrates Groundbreaking of New STEM Building and Opening of New Animatronic Makerspace

English, Valley Chronicle: Thu, Mar 3, 2022

MSJC Receives $500,000 Apprenticeship Grant

staffMSJC Receives $500,000 Apprenticeship Grant

Borrowing to fund pensions could make California the next Puerto Rico

Marc Joffe is the director of Policy Research at the California Policy Center. In 2011, Joffe founded Public Sector Credit Solutions to educate policymakers, investors and citizens about government credit risk. His research has been published by the California State Treasurer’s Office, the Mercatus Center at George Mason University, the Reason Foundation, the Haas Institute for a Fair and Inclusive Society at UC Berkeley and the Macdonald-Laurier Institute among others. He is also a regular contributor to The Fiscal Times. Prior to starting PSCS, Marc was a Senior Director at Moody’s Analytics. He has an MBA from New York University and an MPA from San Francisco State University.

The Valley Chronicle - Borrowing to fund pensions could make Californi

Borrowing to fund pensions could make California the next Puerto Rico

Koi Nation of Northern California and California State Parks Renew Memorandum of Understanding and Celebrate Renaming of Ridge and Trail

Koi Nation of Northern California, USA

MSJC Hosts Temecula Valley Campus Dedication Ceremony

MSJC Hosts Temecula Valley Campus Dedication Ceremony

Stick to a “Go Safely” Game Plan: Celebrate the Holiday

Stick to a “Go Safely” Game Plan: Celebrate the Holiday Season Responsibly National “Drive Sober or Get Pulled Over” Enforcement Campaign Begins Dec. 14

Police Seek Help Locating Hit-and-Run Vehicle

Police Seek Help Locating Hit-and-Run Vehicle

Follow-up: Plane Crashes Near Residential Homes in Hemet

Follow-up: Plane Crashes Near Residential Homes in Hemet

Padilla Joins Farm Workers for a Workday as Part of the

Padilla Joins Farm Workers for a Workday as Part of the ‘Take Our Jobs’ Campaign

Don't undermine scientific discovery -- ever, but espec

Don't undermine scientific discovery -- ever, but especially now

35.3% Of Unvaccinated California Residents Cite Governm

35.3% Of Unvaccinated California Residents Cite Government Distrust

MSJC Celebrates Groundbreaking of New STEM Building and

MSJC Celebrates Groundbreaking of New STEM Building and Opening of New Animatronic Makerspace

MSJC Receives $500,000 Apprenticeship Grant

MSJC Receives $500,000 Apprenticeship Grant

24 Kids Shop with a Cop in Hemet

24 Kids Shop with a Cop in Hemet

Stick to a “Go Safely” Game Plan: Celebrate the Holiday

Stick to a “Go Safely” Game Plan: Celebrate the Holiday Season Responsibly National “Drive Sober or Get Pulled Over” Enforcement Campaign Begins Dec. 14

Four CSUSB alumni win top award for radio show

Four CSUSB alumni win top award for radio show

Padilla Joins Farm Workers for a Workday as Part of the

Padilla Joins Farm Workers for a Workday as Part of the ‘Take Our Jobs’ Campaign

C.W. Driver companies breaks ground on new three-story

C.W. Driver companies breaks ground on new three-story stem education building

MSJC Celebrates Groundbreaking of New STEM Building and

MSJC Celebrates Groundbreaking of New STEM Building and Opening of New Animatronic Makerspace