The Valley Chronicle - How to restore financial sustainability to publ

How to restore financial sustainability to public pensions

Then, for years, whether intentionally or via a culture that encouraged wishful thinking, CalPERS obfuscated the deepening financial challenges from local officials and the public, deferring the day of reckoning.”

■ Edward Ring / Contributed Last month the League of California Cities released a “Retirement System Sustainability Study and Findings.” The findings were not surprising. “Key Findings” were (1) City pension costs will dramatically increase to unsustainable levels, (2) Rising pension costs will require cities to nearly double the percentage of their general fund dollars they pay to CalPERS, and (3) Cities have few options to address growing pension liabilities. These findings corroborate the California Policy Center’s concurrent recent updates on the pension situation in California. In the Jan. 31 update, “California Government Pension Contributions Required to Double by 2024 – Best Case,” and the Jan. 10 update, “How Much More Will Cities and Counties Pay CalPERS?,” using CalPERS own “Public Agency Actuarial Valuation Reports,” it is shown that over the next six years, participating cities will need to increase their payments to CalPERS by 87 percent, from $3.1 billion in the 2017-18 fiscal year to $5.8 billion by the 2024-25 fiscal year. This 87 percent rise in pension payments, officially announced by CalPERS, is definitely a best case. The report from the League of California Cities offers the following footnote on page 1 that underscores this fact: “Bartel Associates used the existing CalPERS’ discount rate and projections for local revenue growth. To the extent CalPERS market return performance and local revenue growth do not achieve those estimates, impacts to local agencies will increase. Additionally, the data does not take into account action pending before the CalPERS Board of Administration to prospectively reduce the employer amortization schedule from its current 30 year term to a 20 year term. Should the Board adopt staff’s recommendation, employer contributions are likely to increase.” The report from the League of California Cities includes a section entitled “What Cities Can Do Today.” This section merits a read between the lines: Analysis of recommendations to cities confronting unsustainable pensions 1. – “Develop and implement a plan to pay down the city’s Unfunded Actuarial Liability (UAL): Possible methods include shorter amortization periods and prepayment of cities UAL. This option may only work for cities in a better financial condition.” 1. (reading between the lines) – PAY CALPERS MORE. Reduce the unfunded liability by making your annual catch-up payment even more than CalPERS is instructing you to pay in their “Public Agency Actuarial Valuation Reports.” Doing this will save money over several years. But only if you can afford it. 2. – “Consider local ballot measures to enhance revenues: Some cities have been successful in passing a measure to increase revenues. Others have been unsuccessful. Given that these are voter approved measures, success varies depending on location.” 2. (reading between the lines) – RAISE TAXES. Do what you’ve been doing incessantly ever since pension benefits were enhanced right before the financial crisis of 2000 wiped out the pension fund surplus. Raise taxes. Say it’s “for the children” and to “protect seniors,” and based on the last several years of data, there is an 80% chance voters will approve the new tax. 3. – “Create a Pension Rate Stabilization Program (PRSP): Establishing and funding a local Section 115 Trust Fund can help offset unanticipated spikes in employer contributions. Initial funds still must be identified. Again, this is an option that may work for cities that are in a better financial condition.” 3. (reading between the lines) – PAY CALPERS MORE. Make payments into a separate investment fund, over and above your annual pension payments, earmarked for CalPERS. Then draw on those funds when the annual pension payments increase. But only if you can afford it. 4. – “Change service delivery methods and levels of certain public services: Many cities have already consolidated and cut local services during the Great Recession and have not been able to restore those service levels. Often, revenue growth from the improved economy has been absorbed by pension costs. The next round of service cuts will be even harder.” 4. (reading between the lines) – CUT SERVICES. 5. “Use procedures and transparent bargaining to increase employee pension contributions: Many local agencies and their employee organizations have already entered into such agreements.” 5. (reading between the lines) – MAKE BENEFICIARIES PAY MORE. Good idea. The League of California Cities might expand on the feasibility of this recommendation and provide examples of where it actually happened (cases where employees agreed to pay more towards their pension benefits but received an equivalent pay increase do not count). 6. – “Issue a pension obligation bond (POB): However, financial experts including the Government Finance Officers Association (GFOA) strongly discourage local agencies from issuing POBs. Moreover, this approach only delays and compounds the inevitable financial impacts.” 6. (reading between the lines) – GO INTO DEBT TO PAY OFF DEBT. Pension obligation bonds are at best a dangerous gamble, at worst a deceptive scam. The recommendation itself (above) dismisses itself in the final sentence, where it states “this approach only delays and compounds the inevitable financial impacts.” What can local elected officials do about unsustainable pensions? 1. – Learn what really happened and communicate it to everyone – employees, elected officials, journalists, citizens. CalPERS, an independent entity largely controlled by public employee unions, joined with powerful union lobbyists to push through pension benefit enhancements beginning in 1999. Despite a sobering and ongoing stock market correction that began only a year later in 2000, over the next several years these two special interests successfully lobbied to roll these financially unsustainable benefit enhancements through nearly every state and local agency in California. Then, for years, whether intentionally or via a culture that encouraged wishful thinking, CalPERS obfuscated the deepening financial challenges from local officials and the public, deferring the day of reckoning. For more on this, read “Did CalPERS Use Accounting “Gimmicks” to Enable Financially Unsustainable Pensions?” 2. – Support legislation that will make it easier to take steps to reduce financially unsustainable pension benefits. For example, state senator John Moorlach – the only actual CPA currently serving in California’s state legislature – has just introduced Senate Bill 1031. According to a Moorlach recent press release, this bill “would protect the solvency of public-employee pensions by making sure each yearly COLA – cost-of-living-adjustment – isn’t so large it tips the underlying fund into insolvency. If a pension system is funded at less than 80 percent, then the COLA would be suspended until the funding status recovers.” Great idea. 3. – Fight for either legislation or a citizen initiative to implement the “Pension Sustainability Principles” that the California League of Cities’ Board of Directors adopted in June 2017. In particular, “converting all currently deemed ‘Classic’ employees to the same provisions (benefits and employee contributions) currently in place for ‘PEPRA’ employees for all future years of service.” 4. – Understand that public employee unions are likely to fight any substantive revisions to their pension benefits, and be prepared to incur their wrath. When they fund candidates to challenge you and destroy you in the next election, own the pension issue. Make it the centerpiece of your campaign and challenge your union-funded opponent on the basis of financial reality. 5. – Thoroughly familiarize yourself with the dynamics of pension finance and the underlying concepts. A good place to start is the CPC primer “How to Assess Impact of a Market Correction on Pension Payments.” Quoting from that article – “Any policymaker who is required to negotiate over pension benefits, explain pension benefits, consider changes to pensions, or understand the impact of pensions on current and future budgets, or for that matter, contemplate any sort of increase to local taxes and fees, needs to understand the basic financial concepts that govern pensions. They should understand the difference between the total pension liability and the unfunded pension liability. They should understand the difference between the normal payment and the unfunded payment. They should understand the difference between unfunded payment schedules that use the “percent of payroll” method vs. the “level payment” method. They should know what “smoothing” is. They should thoroughly understand these concepts and related concepts.” 6. – Local elected officials might consider ways to exit CalPERS. The option of leaving CalPERS should not be dismissed merely because the terms of departure require a large payment. While the buyout terms CalPERS imposes on agencies that want to leave the system are onerous, the funds a city must muster for the buyout are still retained as funds reserved to service their pension liability. This is one situation where financing scenarios might make sense, because once an agency leaves CalPERS, they are no longer subject to many of the restrictions CalPERS places on the ability of agencies to modify pension benefits. The savings realized by having the latitude to make more substantive changes to benefit formulas could mitigate the financing risk. 7. – Finally, remind the members of public employee unions that merely opposing their leadership on pension policies does not automatically make you their enemy. Defined benefit pensions are superior to individual 401K plans, because they do not carry the market risk nor the mortality risk that is inherent in anyone’s individual 401K. But defined benefit plans must be fair to taxpayers, they must be financially sustainable, and the participants must pay their fair share. Appeal not only to their desire to see their pension funds stabilized so they don’t face draconian cuts in the future instead of measured cuts today, but also to the reasons they entered public service, their altruism, their civic pride, their patriotism, their desire to make a contribution to society.Edward Ring is a contributing editor for the California Policy Center. This article was first published on https://californiapolicycenter.org/.

Soboba Band of Luiseño Indians

staffLeprechauns bring lots of green to Soboba Tribal Preschool

English, Valley Chronicle: Thu, Feb 25, 2021

English, Valley Chronicle: Thu, Feb 25, 2021

Koi Nation of Northern California and California State Parks

staffKoi Nation of Northern California, USA

English, Valley Chronicle: Thu, Dec 8, 2022

24 Kids Shop with a Cop in Hemet

staff24 Kids Shop with a Cop in Hemet

English, Valley Chronicle: Thu, Dec 8, 2022

English, Valley Chronicle: Thu, Dec 8, 2022

MSJC Hosts Temecula Valley Campus Dedication Ceremony

staffMSJC Hosts Temecula Valley Campus Dedication Ceremony

English, Valley Chronicle: Thu, Dec 8, 2022

NFPA urges added caution this holiday season, as Christ

staffNFPA urges added caution this holiday season, as Christmas Day and Christmas Eve are among the leading days of the year for U.S. home fires

English, Valley Chronicle: Thu, Dec 8, 2022

Stick to a “Go Safely” Game Plan: Celebrate the Holiday

staffStick to a “Go Safely” Game Plan: Celebrate the Holiday Season Responsibly National “Drive Sober or Get Pulled Over” Enforcement Campaign Begins Dec. 14

English, Valley Chronicle: Thu, Oct 27, 2022

Padilla Hosts Virtual Federal Student Debt Relief Brief

staffPadilla Hosts Virtual Federal Student Debt Relief Briefing to Encourage Californians to Apply

English, Valley Chronicle: Thu, Jun 9, 2022

English, Valley Chronicle: Thu, Jun 9, 2022

Police Seek Help Locating Hit-and-Run Vehicle

staffPolice Seek Help Locating Hit-and-Run Vehicle

English, Valley Chronicle: Thu, Jun 9, 2022

English, Valley Chronicle: Thu, Jun 9, 2022

Four CSUSB alumni win top award for radio show

staffFour CSUSB alumni win top award for radio show

English, Valley Chronicle: Thu, Jun 9, 2022

Follow-up: Plane Crashes Near Residential Homes in Heme

staffFollow-up: Plane Crashes Near Residential Homes in Hemet

English, Valley Chronicle: Thu, Jun 9, 2022

CSUSB Nursing Street Medicine Program partners with new

staffCSUSB Nursing Street Medicine Program partners with new mobile medical clinic

English, Valley Chronicle: Thu, Jun 9, 2022

Padilla Joins Farm Workers for a Workday as Part of the

staffPadilla Joins Farm Workers for a Workday as Part of the ‘Take Our Jobs’ Campaign

English, Valley Chronicle: Thu, Mar 24, 2022

CHP plans DUI checkpoint in Hemet Valley

staffCHP plans DUI checkpoint in Hemet Valley

English, Valley Chronicle: Thu, Mar 24, 2022

Don't undermine scientific discovery -- ever, but espec

staffDon't undermine scientific discovery -- ever, but especially now

English, Valley Chronicle: Thu, Mar 24, 2022

C.W. Driver companies breaks ground on new three-story

staffC.W. Driver companies breaks ground on new three-story stem education building

English, Valley Chronicle: Thu, Mar 24, 2022

English, Valley Chronicle: Thu, Mar 24, 2022

35.3% Of Unvaccinated California Residents Cite Governm

staff35.3% Of Unvaccinated California Residents Cite Government Distrust

English, Valley Chronicle: Thu, Mar 24, 2022

ICYMI: Padilla Highlights From Judge Jackson’s Supreme

staffICYMI: Padilla Highlights From Judge Jackson’s Supreme Court Confirmation Hearing

English, Valley Chronicle: Thu, Mar 24, 2022

MSJC Celebrates Groundbreaking of New STEM Building and

staffMSJC Celebrates Groundbreaking of New STEM Building and Opening of New Animatronic Makerspace

English, Valley Chronicle: Thu, Mar 3, 2022

MSJC Receives $500,000 Apprenticeship Grant

staffMSJC Receives $500,000 Apprenticeship Grant

How to restore financial sustainability to public pensions

Then, for years, whether intentionally or via a culture that encouraged wishful thinking, CalPERS obfuscated the deepening financial challenges from local officials and the public, deferring the day of reckoning.”

■ Edward Ring / Contributed Last month the League of California Cities released a “Retirement System Sustainability Study and Findings.” The findings were not surprising. “Key Findings” were (1) City pension costs will dramatically increase to unsustainable levels, (2) Rising pension costs will require cities to nearly double the percentage of their general fund dollars they pay to CalPERS, and (3) Cities have few options to address growing pension liabilities. These findings corroborate the California Policy Center’s concurrent recent updates on the pension situation in California. In the Jan. 31 update, “California Government Pension Contributions Required to Double by 2024 – Best Case,” and the Jan. 10 update, “How Much More Will Cities and Counties Pay CalPERS?,” using CalPERS own “Public Agency Actuarial Valuation Reports,” it is shown that over the next six years, participating cities will need to increase their payments to CalPERS by 87 percent, from $3.1 billion in the 2017-18 fiscal year to $5.8 billion by the 2024-25 fiscal year. This 87 percent rise in pension payments, officially announced by CalPERS, is definitely a best case. The report from the League of California Cities offers the following footnote on page 1 that underscores this fact: “Bartel Associates used the existing CalPERS’ discount rate and projections for local revenue growth. To the extent CalPERS market return performance and local revenue growth do not achieve those estimates, impacts to local agencies will increase. Additionally, the data does not take into account action pending before the CalPERS Board of Administration to prospectively reduce the employer amortization schedule from its current 30 year term to a 20 year term. Should the Board adopt staff’s recommendation, employer contributions are likely to increase.” The report from the League of California Cities includes a section entitled “What Cities Can Do Today.” This section merits a read between the lines: Analysis of recommendations to cities confronting unsustainable pensions 1. – “Develop and implement a plan to pay down the city’s Unfunded Actuarial Liability (UAL): Possible methods include shorter amortization periods and prepayment of cities UAL. This option may only work for cities in a better financial condition.” 1. (reading between the lines) – PAY CALPERS MORE. Reduce the unfunded liability by making your annual catch-up payment even more than CalPERS is instructing you to pay in their “Public Agency Actuarial Valuation Reports.” Doing this will save money over several years. But only if you can afford it. 2. – “Consider local ballot measures to enhance revenues: Some cities have been successful in passing a measure to increase revenues. Others have been unsuccessful. Given that these are voter approved measures, success varies depending on location.” 2. (reading between the lines) – RAISE TAXES. Do what you’ve been doing incessantly ever since pension benefits were enhanced right before the financial crisis of 2000 wiped out the pension fund surplus. Raise taxes. Say it’s “for the children” and to “protect seniors,” and based on the last several years of data, there is an 80% chance voters will approve the new tax. 3. – “Create a Pension Rate Stabilization Program (PRSP): Establishing and funding a local Section 115 Trust Fund can help offset unanticipated spikes in employer contributions. Initial funds still must be identified. Again, this is an option that may work for cities that are in a better financial condition.” 3. (reading between the lines) – PAY CALPERS MORE. Make payments into a separate investment fund, over and above your annual pension payments, earmarked for CalPERS. Then draw on those funds when the annual pension payments increase. But only if you can afford it. 4. – “Change service delivery methods and levels of certain public services: Many cities have already consolidated and cut local services during the Great Recession and have not been able to restore those service levels. Often, revenue growth from the improved economy has been absorbed by pension costs. The next round of service cuts will be even harder.” 4. (reading between the lines) – CUT SERVICES. 5. “Use procedures and transparent bargaining to increase employee pension contributions: Many local agencies and their employee organizations have already entered into such agreements.” 5. (reading between the lines) – MAKE BENEFICIARIES PAY MORE. Good idea. The League of California Cities might expand on the feasibility of this recommendation and provide examples of where it actually happened (cases where employees agreed to pay more towards their pension benefits but received an equivalent pay increase do not count). 6. – “Issue a pension obligation bond (POB): However, financial experts including the Government Finance Officers Association (GFOA) strongly discourage local agencies from issuing POBs. Moreover, this approach only delays and compounds the inevitable financial impacts.” 6. (reading between the lines) – GO INTO DEBT TO PAY OFF DEBT. Pension obligation bonds are at best a dangerous gamble, at worst a deceptive scam. The recommendation itself (above) dismisses itself in the final sentence, where it states “this approach only delays and compounds the inevitable financial impacts.” What can local elected officials do about unsustainable pensions? 1. – Learn what really happened and communicate it to everyone – employees, elected officials, journalists, citizens. CalPERS, an independent entity largely controlled by public employee unions, joined with powerful union lobbyists to push through pension benefit enhancements beginning in 1999. Despite a sobering and ongoing stock market correction that began only a year later in 2000, over the next several years these two special interests successfully lobbied to roll these financially unsustainable benefit enhancements through nearly every state and local agency in California. Then, for years, whether intentionally or via a culture that encouraged wishful thinking, CalPERS obfuscated the deepening financial challenges from local officials and the public, deferring the day of reckoning. For more on this, read “Did CalPERS Use Accounting “Gimmicks” to Enable Financially Unsustainable Pensions?” 2. – Support legislation that will make it easier to take steps to reduce financially unsustainable pension benefits. For example, state senator John Moorlach – the only actual CPA currently serving in California’s state legislature – has just introduced Senate Bill 1031. According to a Moorlach recent press release, this bill “would protect the solvency of public-employee pensions by making sure each yearly COLA – cost-of-living-adjustment – isn’t so large it tips the underlying fund into insolvency. If a pension system is funded at less than 80 percent, then the COLA would be suspended until the funding status recovers.” Great idea. 3. – Fight for either legislation or a citizen initiative to implement the “Pension Sustainability Principles” that the California League of Cities’ Board of Directors adopted in June 2017. In particular, “converting all currently deemed ‘Classic’ employees to the same provisions (benefits and employee contributions) currently in place for ‘PEPRA’ employees for all future years of service.” 4. – Understand that public employee unions are likely to fight any substantive revisions to their pension benefits, and be prepared to incur their wrath. When they fund candidates to challenge you and destroy you in the next election, own the pension issue. Make it the centerpiece of your campaign and challenge your union-funded opponent on the basis of financial reality. 5. – Thoroughly familiarize yourself with the dynamics of pension finance and the underlying concepts. A good place to start is the CPC primer “How to Assess Impact of a Market Correction on Pension Payments.” Quoting from that article – “Any policymaker who is required to negotiate over pension benefits, explain pension benefits, consider changes to pensions, or understand the impact of pensions on current and future budgets, or for that matter, contemplate any sort of increase to local taxes and fees, needs to understand the basic financial concepts that govern pensions. They should understand the difference between the total pension liability and the unfunded pension liability. They should understand the difference between the normal payment and the unfunded payment. They should understand the difference between unfunded payment schedules that use the “percent of payroll” method vs. the “level payment” method. They should know what “smoothing” is. They should thoroughly understand these concepts and related concepts.” 6. – Local elected officials might consider ways to exit CalPERS. The option of leaving CalPERS should not be dismissed merely because the terms of departure require a large payment. While the buyout terms CalPERS imposes on agencies that want to leave the system are onerous, the funds a city must muster for the buyout are still retained as funds reserved to service their pension liability. This is one situation where financing scenarios might make sense, because once an agency leaves CalPERS, they are no longer subject to many of the restrictions CalPERS places on the ability of agencies to modify pension benefits. The savings realized by having the latitude to make more substantive changes to benefit formulas could mitigate the financing risk. 7. – Finally, remind the members of public employee unions that merely opposing their leadership on pension policies does not automatically make you their enemy. Defined benefit pensions are superior to individual 401K plans, because they do not carry the market risk nor the mortality risk that is inherent in anyone’s individual 401K. But defined benefit plans must be fair to taxpayers, they must be financially sustainable, and the participants must pay their fair share. Appeal not only to their desire to see their pension funds stabilized so they don’t face draconian cuts in the future instead of measured cuts today, but also to the reasons they entered public service, their altruism, their civic pride, their patriotism, their desire to make a contribution to society.Edward Ring is a contributing editor for the California Policy Center. This article was first published on https://californiapolicycenter.org/.

The Valley Chronicle - How to restore financial sustainability to publ

How to restore financial sustainability to public pensions

Koi Nation of Northern California and California State Parks Renew Memorandum of Understanding and Celebrate Renaming of Ridge and Trail

Koi Nation of Northern California, USA

MSJC Hosts Temecula Valley Campus Dedication Ceremony

MSJC Hosts Temecula Valley Campus Dedication Ceremony

Stick to a “Go Safely” Game Plan: Celebrate the Holiday

Stick to a “Go Safely” Game Plan: Celebrate the Holiday Season Responsibly National “Drive Sober or Get Pulled Over” Enforcement Campaign Begins Dec. 14

Police Seek Help Locating Hit-and-Run Vehicle

Police Seek Help Locating Hit-and-Run Vehicle

Follow-up: Plane Crashes Near Residential Homes in Hemet

Follow-up: Plane Crashes Near Residential Homes in Hemet

Padilla Joins Farm Workers for a Workday as Part of the

Padilla Joins Farm Workers for a Workday as Part of the ‘Take Our Jobs’ Campaign

Don't undermine scientific discovery -- ever, but espec

Don't undermine scientific discovery -- ever, but especially now

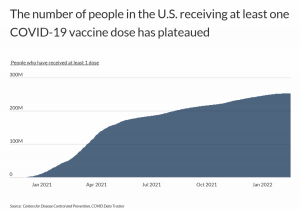

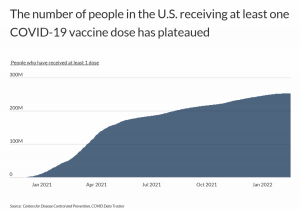

35.3% Of Unvaccinated California Residents Cite Governm

35.3% Of Unvaccinated California Residents Cite Government Distrust

MSJC Celebrates Groundbreaking of New STEM Building and

MSJC Celebrates Groundbreaking of New STEM Building and Opening of New Animatronic Makerspace

MSJC Receives $500,000 Apprenticeship Grant

MSJC Receives $500,000 Apprenticeship Grant

24 Kids Shop with a Cop in Hemet

24 Kids Shop with a Cop in Hemet

Stick to a “Go Safely” Game Plan: Celebrate the Holiday

Stick to a “Go Safely” Game Plan: Celebrate the Holiday Season Responsibly National “Drive Sober or Get Pulled Over” Enforcement Campaign Begins Dec. 14

Four CSUSB alumni win top award for radio show

Four CSUSB alumni win top award for radio show

Padilla Joins Farm Workers for a Workday as Part of the

Padilla Joins Farm Workers for a Workday as Part of the ‘Take Our Jobs’ Campaign

C.W. Driver companies breaks ground on new three-story

C.W. Driver companies breaks ground on new three-story stem education building

MSJC Celebrates Groundbreaking of New STEM Building and

MSJC Celebrates Groundbreaking of New STEM Building and Opening of New Animatronic Makerspace