The Valley Chronicle - font face="Minion Condensed" size="7"How to s

How to save enough for a down payment on a house

Metro Service

Metro ServicePrequalifying for a mortgage can make the home buying process a lot easier, and it also can give first-time buyers an idea of how much they can spend.[/caption] ■ Metro Service A home is the most costly thing many people will ever buy. The process of buying a home can be both exciting and nerve-wracking. One way to make the process of buying a home go more smoothly is to save enough money to put down a substantial down payment. Saving for a down payment on a home is similar to saving for other items, only on a far grander scale. Many financial planners and real estate professionals recommend prospective home buyers put down no less than 20 percent of the total cost of the home they’re buying. Private mortgage insurance Down payments short of 20 percent will require private mortgage insurance, or PMI. The cost of PMI depends on a host of variables, but is generally between 0.3 and 1.5 percent of the original loan amount. While plenty of homeowners pay PMI, buyers who can afford to put down 20 percent can save themselves a considerable amount of money by doing so. Down payments on a home tend to be substantial, but the following are a few strategies prospective home buyers can employ to grow their savings with an eye toward making a down payment on their next home. Decide when you want to buy. The first step to buying a home begins when buyers save their first dollar for a down payment. Deciding when to buy can help buyers develop a saving strategy. If buyers decide they want to buy in five years away, they will have more time to build their savings. If buyers want to buy within a year, they will need to save more each month, and those whose existing savings fall far short of the 20 percent threshold may have to accept paying PMI. Prequalification Prequalify for a mortgage. Before buyers even look for their new homes, they should first sit down with a mortgage lender to determine how much a mortgage they will qualify for. Prequalifying for a mortgage can make the home buying process a lot easier, and it also can give first-time buyers an idea of how much they can spend. Once lenders pre-qualify prospective buyers, the buyers can then do the simple math to determine how much they will need to put down. For example, preapproval for a $300,000 loan means buyers will have to put down $60,000 to meet the 20 percent down payment threshold. In that example, buyers can put down less than $60,000, but they will then have to pay PMI. It’s important for buyers to understand that a down payment is not the only costs they will have to come up with when buying a home. Closing costs and other fees will also need to be paid by the buyers. Examine monthly expenses. Once buyers learn how much mortgage they will qualify for, they will then see how close they are to buying a home. But prospective buyers of all means can save more each month by examining their monthly expenses and looking for ways to save. Buyers can begin by looking over their recent spending habits and then seeing where they can spend less. Cutting back on luxuries and other unnecessary spending can help buyers get closer to buying their next home. Prudent saving Avoid risky investments. Sometimes it’s great to take risks when investing, but risk should be avoided when saving for a down payment on a home. Traditional vehicles like certificates of deposit, or CDs, and savings accounts can ensure the money buyers are saving for their homes is protected and not subject to market fluctuations. Saving enough to make a down payment on a home can be accomplished if buyers stay disciplined with regard to saving and make sound financial decisions.

Soboba Band of Luiseño Indians

staffLeprechauns bring lots of green to Soboba Tribal Preschool

English, Valley Chronicle: Thu, Feb 25, 2021

English, Valley Chronicle: Thu, Feb 25, 2021

Koi Nation of Northern California and California State Parks

staffKoi Nation of Northern California, USA

English, Valley Chronicle: Thu, Dec 8, 2022

24 Kids Shop with a Cop in Hemet

staff24 Kids Shop with a Cop in Hemet

English, Valley Chronicle: Thu, Dec 8, 2022

English, Valley Chronicle: Thu, Dec 8, 2022

MSJC Hosts Temecula Valley Campus Dedication Ceremony

staffMSJC Hosts Temecula Valley Campus Dedication Ceremony

English, Valley Chronicle: Thu, Dec 8, 2022

NFPA urges added caution this holiday season, as Christ

staffNFPA urges added caution this holiday season, as Christmas Day and Christmas Eve are among the leading days of the year for U.S. home fires

English, Valley Chronicle: Thu, Dec 8, 2022

Stick to a “Go Safely” Game Plan: Celebrate the Holiday

staffStick to a “Go Safely” Game Plan: Celebrate the Holiday Season Responsibly National “Drive Sober or Get Pulled Over” Enforcement Campaign Begins Dec. 14

English, Valley Chronicle: Thu, Oct 27, 2022

Padilla Hosts Virtual Federal Student Debt Relief Brief

staffPadilla Hosts Virtual Federal Student Debt Relief Briefing to Encourage Californians to Apply

English, Valley Chronicle: Thu, Jun 9, 2022

English, Valley Chronicle: Thu, Jun 9, 2022

Police Seek Help Locating Hit-and-Run Vehicle

staffPolice Seek Help Locating Hit-and-Run Vehicle

English, Valley Chronicle: Thu, Jun 9, 2022

English, Valley Chronicle: Thu, Jun 9, 2022

Four CSUSB alumni win top award for radio show

staffFour CSUSB alumni win top award for radio show

English, Valley Chronicle: Thu, Jun 9, 2022

Follow-up: Plane Crashes Near Residential Homes in Heme

staffFollow-up: Plane Crashes Near Residential Homes in Hemet

English, Valley Chronicle: Thu, Jun 9, 2022

CSUSB Nursing Street Medicine Program partners with new

staffCSUSB Nursing Street Medicine Program partners with new mobile medical clinic

English, Valley Chronicle: Thu, Jun 9, 2022

Padilla Joins Farm Workers for a Workday as Part of the

staffPadilla Joins Farm Workers for a Workday as Part of the ‘Take Our Jobs’ Campaign

English, Valley Chronicle: Thu, Mar 24, 2022

CHP plans DUI checkpoint in Hemet Valley

staffCHP plans DUI checkpoint in Hemet Valley

English, Valley Chronicle: Thu, Mar 24, 2022

Don't undermine scientific discovery -- ever, but espec

staffDon't undermine scientific discovery -- ever, but especially now

English, Valley Chronicle: Thu, Mar 24, 2022

C.W. Driver companies breaks ground on new three-story

staffC.W. Driver companies breaks ground on new three-story stem education building

English, Valley Chronicle: Thu, Mar 24, 2022

English, Valley Chronicle: Thu, Mar 24, 2022

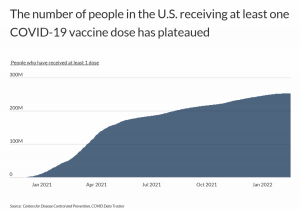

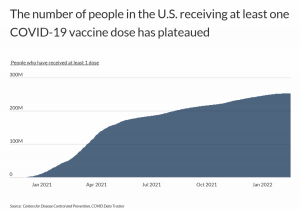

35.3% Of Unvaccinated California Residents Cite Governm

staff35.3% Of Unvaccinated California Residents Cite Government Distrust

English, Valley Chronicle: Thu, Mar 24, 2022

ICYMI: Padilla Highlights From Judge Jackson’s Supreme

staffICYMI: Padilla Highlights From Judge Jackson’s Supreme Court Confirmation Hearing

English, Valley Chronicle: Thu, Mar 24, 2022

MSJC Celebrates Groundbreaking of New STEM Building and

staffMSJC Celebrates Groundbreaking of New STEM Building and Opening of New Animatronic Makerspace

English, Valley Chronicle: Thu, Mar 3, 2022

MSJC Receives $500,000 Apprenticeship Grant

staffMSJC Receives $500,000 Apprenticeship Grant

How to save enough for a down payment on a house

Metro Service

Metro ServicePrequalifying for a mortgage can make the home buying process a lot easier, and it also can give first-time buyers an idea of how much they can spend.[/caption] ■ Metro Service A home is the most costly thing many people will ever buy. The process of buying a home can be both exciting and nerve-wracking. One way to make the process of buying a home go more smoothly is to save enough money to put down a substantial down payment. Saving for a down payment on a home is similar to saving for other items, only on a far grander scale. Many financial planners and real estate professionals recommend prospective home buyers put down no less than 20 percent of the total cost of the home they’re buying. Private mortgage insurance Down payments short of 20 percent will require private mortgage insurance, or PMI. The cost of PMI depends on a host of variables, but is generally between 0.3 and 1.5 percent of the original loan amount. While plenty of homeowners pay PMI, buyers who can afford to put down 20 percent can save themselves a considerable amount of money by doing so. Down payments on a home tend to be substantial, but the following are a few strategies prospective home buyers can employ to grow their savings with an eye toward making a down payment on their next home. Decide when you want to buy. The first step to buying a home begins when buyers save their first dollar for a down payment. Deciding when to buy can help buyers develop a saving strategy. If buyers decide they want to buy in five years away, they will have more time to build their savings. If buyers want to buy within a year, they will need to save more each month, and those whose existing savings fall far short of the 20 percent threshold may have to accept paying PMI. Prequalification Prequalify for a mortgage. Before buyers even look for their new homes, they should first sit down with a mortgage lender to determine how much a mortgage they will qualify for. Prequalifying for a mortgage can make the home buying process a lot easier, and it also can give first-time buyers an idea of how much they can spend. Once lenders pre-qualify prospective buyers, the buyers can then do the simple math to determine how much they will need to put down. For example, preapproval for a $300,000 loan means buyers will have to put down $60,000 to meet the 20 percent down payment threshold. In that example, buyers can put down less than $60,000, but they will then have to pay PMI. It’s important for buyers to understand that a down payment is not the only costs they will have to come up with when buying a home. Closing costs and other fees will also need to be paid by the buyers. Examine monthly expenses. Once buyers learn how much mortgage they will qualify for, they will then see how close they are to buying a home. But prospective buyers of all means can save more each month by examining their monthly expenses and looking for ways to save. Buyers can begin by looking over their recent spending habits and then seeing where they can spend less. Cutting back on luxuries and other unnecessary spending can help buyers get closer to buying their next home. Prudent saving Avoid risky investments. Sometimes it’s great to take risks when investing, but risk should be avoided when saving for a down payment on a home. Traditional vehicles like certificates of deposit, or CDs, and savings accounts can ensure the money buyers are saving for their homes is protected and not subject to market fluctuations. Saving enough to make a down payment on a home can be accomplished if buyers stay disciplined with regard to saving and make sound financial decisions.

The Valley Chronicle - font face="Minion Condensed" size="7"How to s

How to save enough for a down payment on a house

Koi Nation of Northern California and California State Parks Renew Memorandum of Understanding and Celebrate Renaming of Ridge and Trail

Koi Nation of Northern California, USA

MSJC Hosts Temecula Valley Campus Dedication Ceremony

MSJC Hosts Temecula Valley Campus Dedication Ceremony

Stick to a “Go Safely” Game Plan: Celebrate the Holiday

Stick to a “Go Safely” Game Plan: Celebrate the Holiday Season Responsibly National “Drive Sober or Get Pulled Over” Enforcement Campaign Begins Dec. 14

Police Seek Help Locating Hit-and-Run Vehicle

Police Seek Help Locating Hit-and-Run Vehicle

Follow-up: Plane Crashes Near Residential Homes in Hemet

Follow-up: Plane Crashes Near Residential Homes in Hemet

Padilla Joins Farm Workers for a Workday as Part of the

Padilla Joins Farm Workers for a Workday as Part of the ‘Take Our Jobs’ Campaign

Don't undermine scientific discovery -- ever, but espec

Don't undermine scientific discovery -- ever, but especially now

35.3% Of Unvaccinated California Residents Cite Governm

35.3% Of Unvaccinated California Residents Cite Government Distrust

MSJC Celebrates Groundbreaking of New STEM Building and

MSJC Celebrates Groundbreaking of New STEM Building and Opening of New Animatronic Makerspace

MSJC Receives $500,000 Apprenticeship Grant

MSJC Receives $500,000 Apprenticeship Grant

24 Kids Shop with a Cop in Hemet

24 Kids Shop with a Cop in Hemet

Stick to a “Go Safely” Game Plan: Celebrate the Holiday

Stick to a “Go Safely” Game Plan: Celebrate the Holiday Season Responsibly National “Drive Sober or Get Pulled Over” Enforcement Campaign Begins Dec. 14

Four CSUSB alumni win top award for radio show

Four CSUSB alumni win top award for radio show

Padilla Joins Farm Workers for a Workday as Part of the

Padilla Joins Farm Workers for a Workday as Part of the ‘Take Our Jobs’ Campaign

C.W. Driver companies breaks ground on new three-story

C.W. Driver companies breaks ground on new three-story stem education building

MSJC Celebrates Groundbreaking of New STEM Building and

MSJC Celebrates Groundbreaking of New STEM Building and Opening of New Animatronic Makerspace